US Credit Cards With Smart Chip Technology

US Credit Cards With Smart Chip Technology

by The Points Guy on May 30, 2013

As the summer travel season kicks into high gear, I know many of you (like me) are planning some great trips abroad, and are already thinking about which credit cards you should be packing along with your swimsuits and hiking boots.

Of course you want to get a card with no foreign transaction fees (read this post for a roundup of the best current credit card offers for cards with no forex fees). But something else you might want to consider is whether your credit cards have Smart Chip technology. Having a SmartChip makes it easier to use this card abroad.

Having a Smart Chip makes it easier to use this card abroad.

Smart Chip is a credit card technology where cards are embedded with chips and a cardholder must put in their pin or sign for each transaction to be approved. With "chip & pin" especially, this is an ultra-secure method that makes it much harder for credit card hackers and fraudsters to steal from consumers since, rather than just stealing the information contained in a card's magnetic strip, they'd have to know the carrier's pin number as well. The other type of chip card, "chip & signature," function more like US swipe cards, only they can be used with portable electronic readers that require you to insert the card rather than swipe it, and then sign for it as you would with a regular old swipe card. Although chip & pins are prevalent in Europe, the cards issued in the US with chips tend to be overwhelmingly chip & signature, so you might still have some issues using them at certain merchants, but having a chip at all can be a big help when using cards at ticket machines or other vendors that require a chip of some sort.

Most US cards are just "swipe and sign" cards with a simple magnetic strip and the verification of signature standing between you and credit card fraud. From time to time, US swipe cards also make it more difficult to charge things while abroad where many merchants use mobile credit card portals where you stick your card into a slot and enter your pin into a keyboard rather than swiping it through a reader. While many merchants, hotels and restaurants let you use your swipe cards, many, especially in Europe, do not, including some restaurants, hotels and even public transport.

In fact, TPG reader David just wrote me to tell me that the Royal Opera House in London's Covent Garden will no longer be accepting any credit cards except chip and pin ones, so if he wants to eat there before or after a performance, he'll have to carry cash with him, which is a bummer on many levels. Unfortunately, he might be out of luck unless he has one of the very few US cards with chip & pin technology, but I'd suggest he take his chip & signature card with him (and cash just in case) because sometimes vendors are still able to make those work. Want a drink or snack at the Royal Opera House? You'll need a chip & pin card to pay for it.

Want a drink or snack at the Royal Opera House? You'll need a chip & pin card to pay for it.

Most US cards don't have chip technology because it is expensive and not required by US merchants, so issuers have been dragging their feet on issuing new cards with them. The good news, though, is that we're seeing more and more issuers putting chips in more and more cards because of consumer demand, so if you're in the market for a new credit card, chances are you can find one that suits your needs financially and has a chip in it. Just be sure that it also does not charge foreign transaction fees since some cards, even with Smart Chips, do.

The bad news is, some of my favorite travel credit cards including both the Sapphire Preferred and Ink Bold from Chase do not offer Smart Chips at this time, and there is no concrete information on whether Chase is planning to add them anytime soon.

With that in mind, I have put together this list of all the travel credit cards out there that currently have Smart Chips in them (although I might have missed a few, so if you see any missing, please leave a comment!). If you already have one or several of these cards but they don't have chips in them, you can call your issuer to request a new card with a Smart Chip and they should reissue you one for free.

If you don't have a chip card and don't plan on getting one before your next trip abroad, you can still get one from the Travelex money exchange stores in airports. However, these are basically just pre-loaded charge cards, and when you put money on them in foreign currencies, Travelex takes a huge cut on foreign exchanges. Plus, I'd rather have a no forex fee credit card than a Travelex card in my wallet any day! If I missed any cards, please feel free to comment and I'll add to this list.

SNIP

Read more: here

Maximizing Smart Chip Credit Cards in Europe

Maximizing Smart Chip Credit Cards in Europe

by The Points Guy on July 9, 2012

For those of you who don't know, in Europe, they utilize different credit technology called "chip and pin," which is s system where cards are embedded with smart chips and a cardholder must put in their pin for each transaction to be approved. It is an ultra-secure method that makes it much harder for credit card hackers and fraudsters to steal from consumers since, rather than just stealing the information contained in a card's magnetic strip, they'd have to know the carrier's pin number as well.

As most of you know, however, most US cards are just your garden variety swipe cards with a simple magnetic strip and a signature between you and credit card fraud. Beyond the security implications, our US swipe cards also make it more difficult to charge things while abroad where many merchants use mobile credit card portals where you stick your card into a slot and enter your pin into a keyboard rather than swiping it through a reader. Granted, many merchants, hotels and restaurants let you use your swipe cards, but while I was on a quick trip to Europe this past week, there were several times when my old-fashioned American credit card just wasn't accepted. Imagine how happy I was that I carry a few cards that have chip technology in them, such as the Chase Hyatt Visa and the British Airways card. (Note: These aren't chip and pin cards - they still require a signature, though you use them in the chip slot of a machine and you don't have to swipe them. However, I had no issues using them even at automated machines that didn't make me sign anything.)

Besides being more secure, Smart Chip technology can save you time and money while traveling abroad.

Smart Chip Situations

Of course, you should first be sure your credit card does not carry foreign transaction fees if you're planning to travel abroad so you don't get hit with 2-3% fees on all your charges. However, based on my experiences, my best advice is if you're going to Europe anytime soon, have a chip card to cover you in the instances where a merchant won't swipe cards. My most unique situation occurred after a late dinner in Paris one evening. By the time we left the restaurant it was nearly 1:00am, and the metro was closed. There were no taxis to be found, and the hotel was miles away. Paris has a fantastic system of public-use bicycle stations throughout the city where you can rent bikes even for short periods of time, but the automated machines will not take traditional US swipe cards. They do, however, accept chip cards, and I was able to use my BA Visa to rent one and bike back to the hotel instead, saving time (and my aching muscles).

To take another example, when you arrive at Charles de Gaulle and want to take the RER into the city, the machines selling tickets in the terminal accept only credit cards or coins, so you either have to have change on you for the 9 euro fare, or a Smart Chip credit card. The same is true of ticket machines in metro stations and French rail ticket machines. You can still pay for your tickets with either cash or getting in line at the ticket window, but having a chip card can save a ton of time, especially if you're in a hurry to catch a train.

Chase Leads The Way

So far, the only US cards I know of with Smart Chips are the Chase British Airways Visa, the Chase Hyatt card and the US Bank FlexPerks Visa Signature. I think it's great that Chase is leading the pack and issuing these cards – and there's a rumor that they'll add this technology to the Sapphire Preferred soon as well, which I'm hopeful about. As for the US Bank card, though it has a Smart Chip, making things easier when you're abroad, it also still levies 2-3% foreign transaction fee, negating pretty much all of its value when you use it abroad. Amex doesn't have any Smart Chip cards in the US to my knowledge, however, per reader comments below, it looks like certain Citi cards including the Executive AAdvantage World Mastercard and the ThankYou Premier card are now being issued with Smart Chips as well.

The reason more US cards don't have chips is that the technology is expensive and not required by US merchants, so issuers are dragging their feet on this evolution. However, if enough consumers ask, we should start seeing more and more of these cards over time.

Just as a quick tip: if you don't have a chip card and don't plan on getting one before your next trip abroad, you can still get one from the Travelex money exchange stores in airports. However, these are basically just pre-loaded charge cards, and when you put money on them in foreign currencies, Travelex takes a huge cut on foreign exchanges. Plus, I'd rather have a Chase card than a Travelex card in my wallet any day!

Here's another tip: If you already have the British Airways Visa or the Hyatt card and it doesn't have a chip in it, you can call Chase to request a new card with a Smart Chip and they'll send it to you for free. These cards have both the magnetic stripe and the chip, so you get the best of both worlds…plus the peace of mind knowing that, should you be stranded in Paris late at night with no taxis in sight, you'll still be able to rent a bike and pedal your way home

FAQ: EMV Chip Card Technology

FAQ: EMV Chip Card Technology

What is EMV?

EMV chip technology is becoming the global standard for credit card and debit card payments. Named after its original developers (Europay, MasterCard® and Visa®), this smart chip technology features payment instruments (cards, mobile phones, etc.) with embedded microprocessor chips that store and protect cardholder data. This standard has many names worldwide and may also be referred to as: "chip and PIN" or "chip and signature."

What is chip technology?

Chip technology is an evolution in our payment system that will help increase security, reduce fraud and enable the use of future value-added applications. Chip cards are standard bank cards that are embedded with a micro computer chip. Some may require a PIN instead of a signature to complete the transaction process.

What makes EMV different than the traditional magnetic stripe card payment?

Simply put, EMV (also referred to as chip-and-PIN, chip-and-signature, chip-and-choice, or generally as chip technology) is the most recent advancement in a global initiative to combat fraud and protect sensitive payment data in the card-present environment. A cardholder's confidential data is more secure on a chip-enabled payment card than on a magnetic stripe (magstripe) card, as the former supports dynamic authentication, while the latter does not (the data is static). Consequently, data from a traditional magstripe card can be easily copied (skimmed) with a simple and inexpensive card reading device – enabling criminals to reproduce counterfeit cards for use in both the retail and the CNP environment. Chip (EMV) technology is effective in combating counterfeit fraud with its dynamic authentication capabilities (dynamic values existing within the chip itself that, when verified by the point-of-sale device, ensure the authenticity of the card).

What other incentives are there to accept chip cards?

In addition to the reduction of fraud and related chargebacks, there are other cost savings associated with EMV acceptance. The payment brands are doing their part to ensure that chip-bearing customers can pay at chip-enabled businesses. For example, Visa and MasterCard have issued upcoming rules and guidelines for processors and merchants to support EMV chip technology. Visa is introducing their Technology Innovation Program (TIP) to the U.S. region, which waives an annual PCI-DSS audit if 75 percent of the merchant's Visa transactions are processed through a dual contactless and contact EMV certified device. MasterCard is introducing their PCI-DSS Compliance Validation Exemption Program to the U.S. region, which also waives the annual PCI-DSS audit if 75 percent of the merchants' MasterCard transactions are processed through a dual contactless and contact EMV certified device.

Another Visa and MasterCard ruling is the liability shift. Once this goes into effect, merchants who have not made the investment in chip-enabled technology may be held financially liable for card-present fraud that could have been prevented with the use of a chip-enabled POS system.

Is this technology unique to the United States?

No. The chip technology standard for payment was first used in France in 1992. Today, there are more than 1 billion chip cards used around the world. The U.S. is one of the few industrialized nations that have not fully transitioned to this technology standard.

Why should I invest in chip card acceptance now?

Preventing the growth of fraudulent activity is one of the main reasons the industry is moving toward EMV technology. Chip cards make it difficult for fraud organizations to target cardholders and businesses alike. As a result, more and more chip cards are being introduced by U.S. financial institutions in order to support and switch over to this technology.

Are there any best practices for EMV migration?

Training and product awareness at both the business and the employee level is crucial to a successful implementation. As EMV acceptance is very different than the traditional magstripe (the card is inserted into the terminal as opposed to swiped, for example), it is imperative that everyone is familiar with the new requirements to make the customer experience as smooth as possible.What does EMV migration mean for card-not-present (CNP) merchants? As EMV technology is adopted in the card present space, it is expected that fraud will also shift to the least secure channels, including CNP. From an online fraud perspective, it's important that CNP businesses be prepared for this anticipated shift, as experienced in other regions that have already migrated toward chip card technology.Don't wait to migrate. You may begin to feel the pressure once the EMV card migration starts to reach its critical mass – with issuing banks beginning to issue chip cards to new and existing customers. Businesses that have not already migrated to EMV may consequently have to answer to their customers as to why they have to continue to swipe their new chip cards – especially when the market presents chip technology as the safer way to pay. Don't wait until the last minute to migrate your business.

Get a business plan together even before implementation begins. As equipment upgrades have the potential to be both costly and time consuming, it's best to get started early. Figure out how much it's going to cost, how long it's going to take and plan accordingly. Also, when planning on how to update your systems to support this change, you will want to take a hard look at the cost vs. benefits of EMV. In some cases, fraud prevention alone may not deliver an acceptable ROI for effort required to implement this technology. With that, you will want to achieve other benefits when displacing your existing hardware or software solutions (e.g. update network connectivity, build out support for a loyalty or gift card program, include ability to accept contactless / mobile payment transactions, etc…).

As fraud migrates online and fraudsters continue to get more sophisticated, the tools you have in place now may no longer be advanced enough to protect you and your customers. Strategy is key and it's imperative to take the extra measures to know good customers and good customer behavior (beyond just AVS and CVV). It is recommended that you avoid the use of Address Verification and card validation values (security code) checks as your sole fraud detector since the false positive exposure can be high with these tools alone. You should consider strengthening the value of these tools by supporting additional technology to confirm and mitigate fraudulent activity.

A good fraud prevention tool will enable in-house management in real time, with no negative impact on your good customers' experiences (those transactions that are not fraudulent in nature). Having the ability to control your fraud prevention at the business level, without the required assistance of IT support or third-party vendors, helps to ensure that your good transactions get through and your customer is not burdened with holds or declines based on suspected fraud. Simply put, you can prevent the fraudulent transactions without compromising the legitimate ones. This will protect you, your good customers, your bottom line and your brand.

How am I impacted by the liability shift?

With the liability shift, if a chip card is presented to a merchant that has not adopted a terminal that is certified for chip card acceptance, liability for counterfeit fraud may shift to the merchant's acquirer – who may then pass this fee back to the merchant. The liability shift encourages chip adoption since any chip-on-chip transaction (chip card read by a chip certified terminal) provides the dynamic authentication data that helps to better protect all parties. In addition, if a counterfeit magnetic stripe card is presented at a chip certified terminal, the liability for the counterfeit fraud will be the responsibility of the card issuer.

Why should I partner with Chase Paymentech to implement this technology?

We have been supporting chip technology in Canada for several years, and we are playing an active role in ensuring our merchants are ready when the U.S. payments industry mandates it.

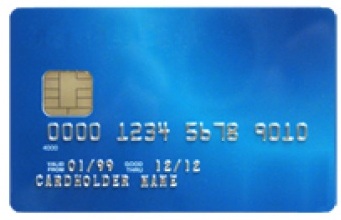

EMV for Small Business

How is a chip card different from a traditional payment card? A chip payment card looks just like a traditional card with an embedded chip in addition to the standard magnetic stripe on the back of the card. What you see on the card is not the actual microchip but a protective overlay. The microchip provides an additional level of authenticity for the transaction.

What do I do when a customer presents a chip card?

Chip cards will still have a magnetic stripe during the U.S. migration to EMV to ensure that customers can continue to pay until all merchants have been given the time to upgrade their equipment.

How does EMV chip technology work?

Your EMV-enabled device will communicate with the chip inside the customer's smart card to determine whether or not the card is authentic. Generally, the terminal will prompt the customer to sign or enter a PIN to validate their identity. This process enhances the authentication of both the card and cardholder, effectively reducing the possibility that your business will accept a counterfeit card or be held liable for a fraud-related chargeback.

Will I still be able to accept traditional credit and debit cards? The Future Proof terminal has a magnetic stripe swipe reader and you can continue to accept payment cards that are not chip-enabled.

Chip cards will still have a magnetic stripe during the U.S. migration to EMV, to ensure that customers can continue to pay until all merchants have been given the time to upgrade their equipment.

How will chip cards impact the checkout experience at my business? To process a chip card transaction, follow these four simple steps:

Identify whether the card is a chip card.What do I do if my customer is using their chip card for the first time? Make sure the card is inserted into the terminal's chip reader slot face up with the chip first. The card must stay in the terminal's chip reader slot for the duration of the transaction, which ends when the receipt is being printed. If the card is removed before the end of a transaction, the payment will not be processed.If it's a chip card, the customer should then insert it into the chip card reader (slot on the bottom-front of the terminal) and leave it there until the transaction is complete.

Follow the prompts displayed on the terminal.

Let the customer complete the transaction by keying in a PIN or signing the receipt.

Am I required to support EMV?

No, you are not required to support EMV in the U.S. region at this time. However, one item that you need to consider is that even if your organization hasn't been targeted by high levels of card present fraud in the past, you may be putting yourself at risk in the future, as fraud will migrate to the weakest technology (magnetic stripe) Therefore, you may want to ensure that all your terminals are chip capable and that your payment processing application can support chip card acceptance. The good news is that most terminals deployed in the last five years are already chip capable so you may be ready to accept these cards today.

What if I have more questions?

The Quick Reference Guide for our Future Proof Terminal has many tips and troubleshooting steps specifically related to chip cards. As you become familiar with chip technology, remember that you can call for technical support if you have any questions.

EMV chip technology

EMV chip technology - Named after its original developers (Europay, MasterCard® and Visa®),

This standard has many names worldwide and may also be referred to as: "chip and PIN" or "chip and signature."

EMV (also referred to as chip-and-PIN, chip-and-signature, chip-and-choice, or generally as chip technology).

CVM - Cardholder Verification Method

MSR - Magnetic Strip Reader

Technical details on EMV chip technology

Here are some links to the nitty, gritty technical details on the specs for these EMV credit cards chips:

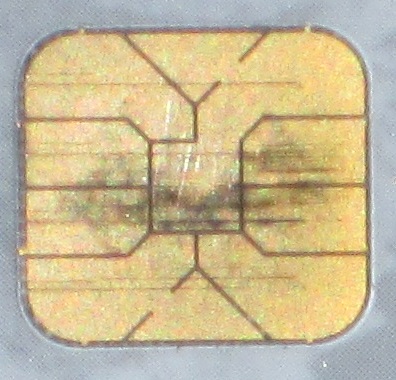

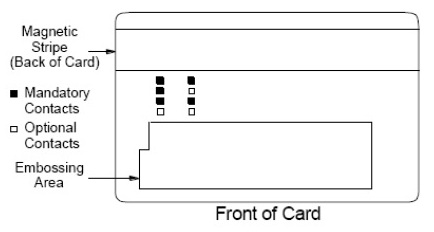

Pin layout on the EMV card

|

|

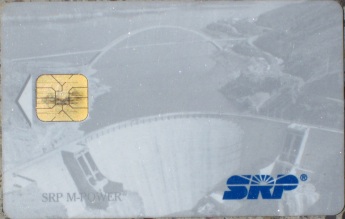

SRP or Salt River Project EMV card

Here is an SRP EMV card I found which seems to have an EMV chip on it.This is a photo of the whole card:

Note the top pin seems to be connected to the middle pin. The bottom pin seems to be connected to the left pin.

That doesn't seem to jive with the pin out given in the privious diagram.